EldersWealth offers high-security debt instruments – bonds, for investors who are looking to invest in relatively safer investment option than stocks.

How bonds work?

When the Government, Banks or a corporate entity wants to raise money, they borrow a sum from investors and in return, agree to repay the amount plus interest on a periodic basis. This agreement between the issuer (borrower) and investor (lender) is commonly known as ‘bonds’. This interest rate is called as ‘coupon rate’ and the pre-defined time is called as ‘maturity’.

Bonds are typically considered as the safe investment avenue as they can offset exposure to equity market volatility and offer stable income stream/cash flow. Today, there are various types of bonds available in the market and each one of them suitable for different types of investors and goals.

Types of Bonds

Capital Gains/ 54EC bonds

Capital gains bonds can help investors save long term capital gains tax. Their AAA rating and the lock-in period of 5 years are some of the other features of these bonds. The maximum amount one can invest in these bonds is up to Rs. 50 lakh and the tax benefit is available u/s 54EC of Income Tax act.

Government bonds

Issued by the state and central government of India, Government Bonds offer a combination of assured fixed returns with complete safety of your principal amount. These is typically a long term investment option and interest rates offered are subject to change due to external factors such as inflation, investor sentiments or change in regulatory policies.

Secondary Market bonds

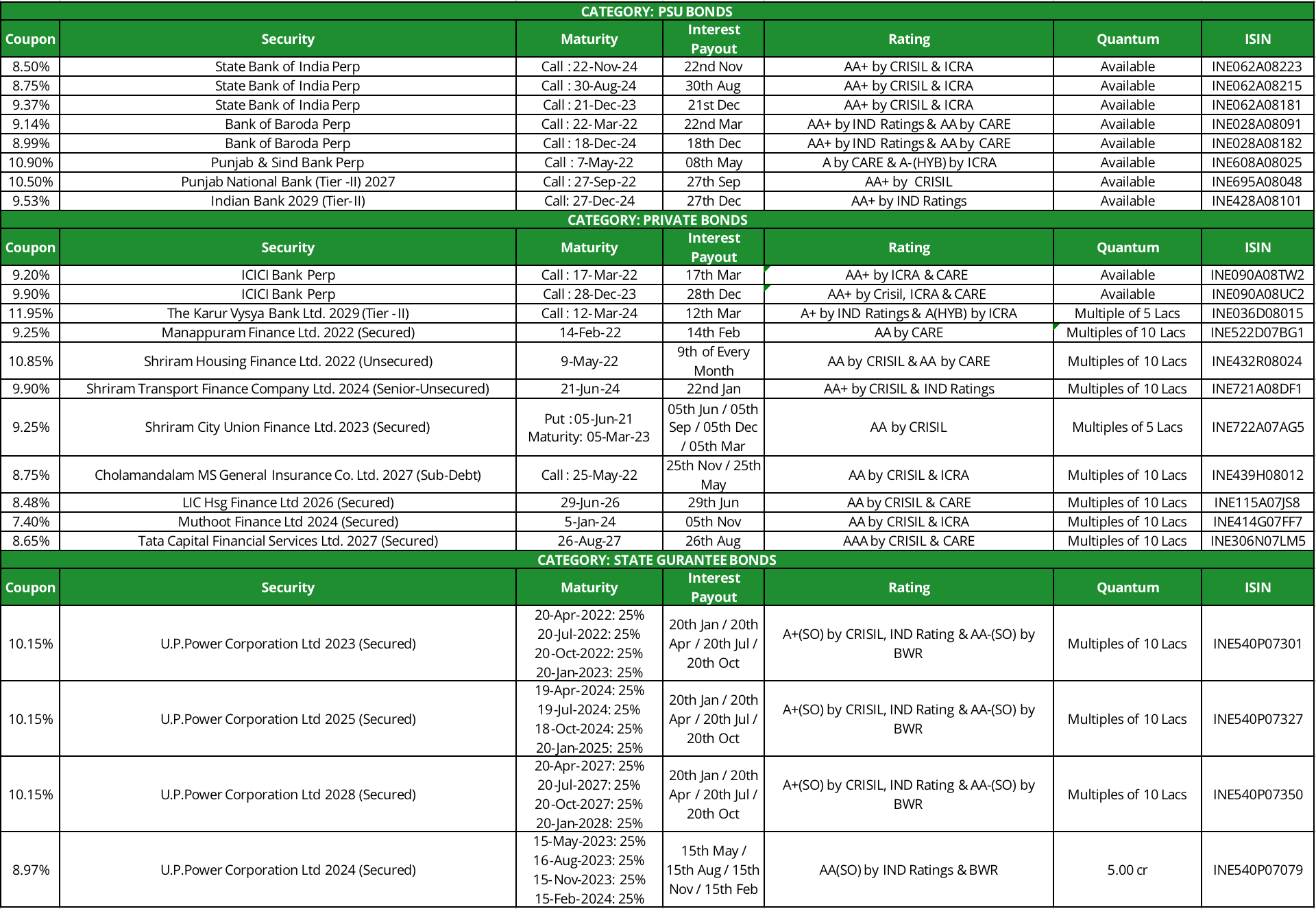

These types of bonds are traded in secondary market to offer investors the benefit of liquidity and safety at the same time. There are two types of bonds bought and sold in the secondary market:

Fixed maturity bonds

These bonds carry consistent coupon rates throughout the tenure. Investors know the exact amount they will receive at the end of tenure, irrespective of market fluctuations.

Perpetual bonds

Perpetual bonds are fixed-security investment options without any maturity period. Issuers pay interest for perpetuity (forever) and the principal amount is redeemable through either the call or put option announce at the time of issuance of these bonds. These Bonds are traded in secondary markets like how it is in case of Equities. The coupon rate of interest too is fixed at the time of issuance along with the interest payment dates.

There’s a prevailing misconception that bonds are a suitable investment option for traditional and conservative investors. Contrary to this misconception, bonds canplay a crucial role in building aconstructive asset allocation strategy for investors of all age groups and risk appetite. With the help of professional guidance and understanding of the product, one can invest in bonds to fulfil various life stage goals.