Just like banks, private companies or non-banking financial companies also collect deposits for a fixed tenure and at a pre-decided interest rate. These deposits are known as Corporate Fixed Deposits.

EldersWealth brings you a range of Corporate Fixed Deposits (FDs) of different institutions, tenures & interest rates. They provide guaranteed returns and the interest rates offered by Corporate FDs are relatively higher than traditional bank fixed deposits and even a little higher for senior citizens; therefore investors looking for relatively higher earnings should include these in their investment portfolio. More importantly, the minimum lock-in for corporate FDs is 6 months, meaning, you can redeem your funds after six months which makes them more liquid than traditional FDs. The penalty period on early redemption/withdrawal for Corporate FDs is lower than typical bank fixed deposits.

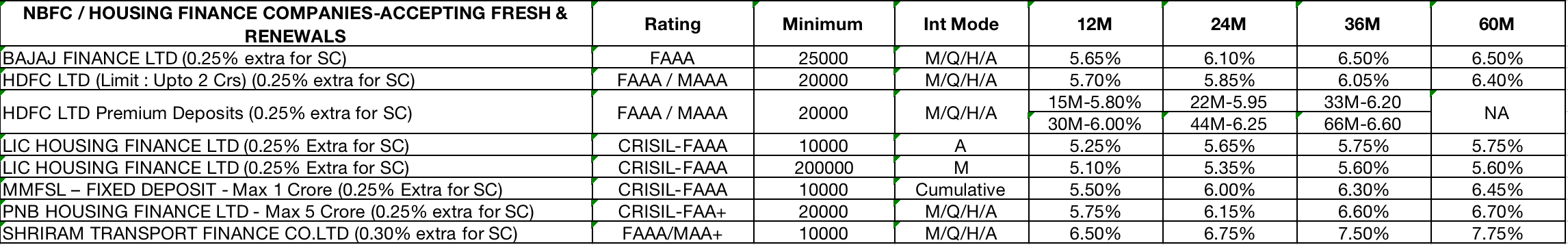

We have handpicked some of the best corporate FDs which are high-safety and quality options to meet your investment goals. It is important to pick companies with a stable and high credit-rating so that you can avail the dual benefits of returns and safety of capital.

Apart from credit profile of the company it is important to check the overall financial health of the company. Understand why the company is raising funds and how it has been doing on the account books in the recent past. You should also check if the company has paid regular dividends to its depositors and not defaulted in the past. If there’s a consistent lag in the payment of dividends, there might be a financial instability in the firm.